Hi friend,

I first heard about Madeline’s book through my friend

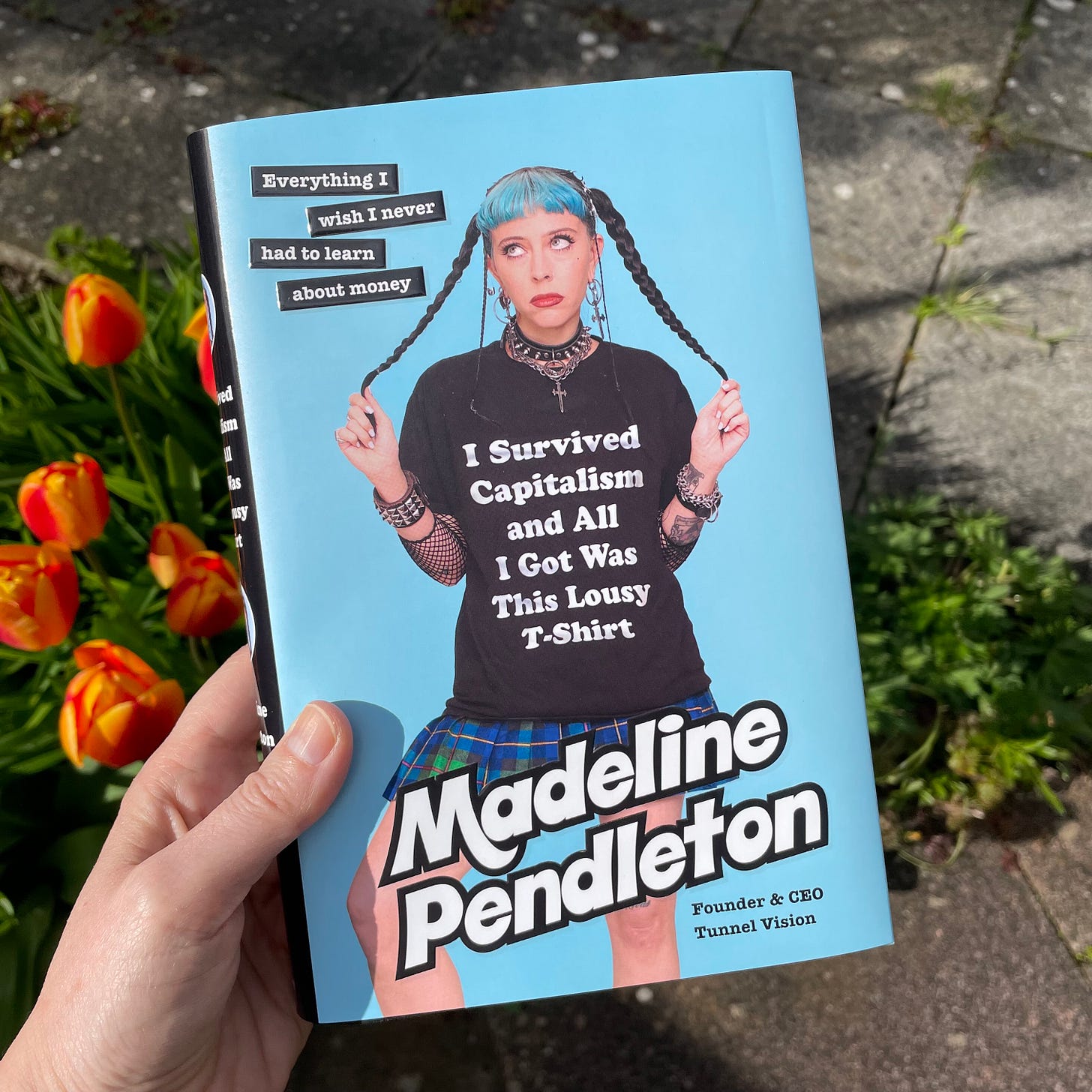

. She read it in just two days and felt I’d enjoy it. I ended up getting a couple copies from Madeline’s publisher, Doubleday (thank you again, Anne!) and was excited to read it. I wasn’t familiar with Madeline’s other work (her TikTok account—because I’m one of the people who doesn’t use it—or her business, Tunnel Vision) so I had no expectations of the book. All I knew is that it was a memoir by an American author. But it is so much more than that…This is a story about a woman who grew up in poverty (but didn’t know it) and has worked her *ss off to get to where she is today. The story of a woman who had to use debt to get ahead, and felt the weight of it for years. A woman who has seen firsthand how capitalism + debt can destroy people’s lives (and cause them to take their own). A woman who has taken everything she’s learned about money and capitalism and tried to create a more equitable world in her communities—both in-person (via her own business) and online (through all she shares).

You do not have to share Madeline’s experiences, to take something from this book. And you do not even have to agree with all of her beliefs and opinions on capitalism. But reading it will help you understand it better, and remind you why this system is not working for many people. And, it’s told with radical transparency, and through the lens of someone who does not act like a victim, but rather shows JUST HOW MUCH WORK it takes to survive and even attempt to change your circumstances. (And it should not take this much work…)

I basically only have good things to say about this book, so I’ll just get into it. And if you get to the end of this and find you want to read it yourself, I’m giving away 1 copy! And will happily ship it to one of our paying subscribers anywhere in the world. Yay! 💸📖

What I liked about I SURVIVED CAPITALISM…

When I started thinking about how I would review this book, I wondered if it would be appropriate to just say: It’s amazing, please read it! Which… might be a good enough review! But I’ll tell you at least a few things I liked about it:

The way it’s structured. Each chapter outlines a period of time in Madeline’s (financial) life and is followed by something she calls a “Capitalism Survival Skill.” Things like: how to build credit, how to get a job, how to rent an apartment, etc. This is where she takes what she’s learned and gives practical tips to readers… and they were INCREDIBLE. (Although the tips for “making it out of a recession alive” on pages 131-133 felt almost like a way of life—at least for elder millennials. It feels like this is how many of us have been living since graduating…)

The honesty and transparency. You can see this in her storytelling, and all the numbers and situations she shares. But it also shows up in those Capitalism Survival Skills. She doesn’t give the same personal finance advice you will find in almost every other book. Madeline shares REAL things that REAL people have to do, in order to get someone to take a chance on them, so they can try to change their circumstances. Like: ask a friend to be a fake reference for you. (THAT’S REAL!)

The empathy and humanity. It’s clear that Madeline has done some deep thinking on everything she shares in the book. She shows so much empathy and compassion for other people, and anyone whose story she shares. It’s also obvious how much she cares about her community. But her humanity shows up again in the survival skills. The tips for “how to manage financial stress” (page 197) and “how to feel happy when everything around you feels sad” (pages 210-211) felt like some of the most supportive advice I’ve read. More personal finance books like this in the future, please.

Some of the quotes I underlined while reading:

“Capitalism is a matter of life and death. The stakes are high, and if you lose, it might come for you in ways you’d never expect.” (p. xv)

“Money is both a practical and deeply emotional thing. On the one hand, it’s a math problem. You add up your expenses and subtract them from your monthly income. It’s cold and calculated and precise. On the other hand, if the numbers don’t add up quite the way you’d like, it feels less like a math problem and more like a you problem.” (p. 2)

“There are rules to follow if you want to make it to the end, but we all start in different positions on the board with different tools by our side.” (p. 21)

“The more I learned about my family’s relationship with money, the more it felt like my destiny was predetermined from birth. It didn’t matter that I got straight A’s or graduated from high school early as valedictorian and got nearly a perfect score on my SAT. Kids from more comfortable economic backgrounds would always have more resources, from better-quality schools to more support and better networking connections.” (p. 241)

“The American Dream tells us that we can change our economic reality if only we work hard enough, but time and time again, we see that class mobility is a myth.” (p. 242)

“The first day I met Kelsey, she told me she just wanted to have a nice life. At the time, I wasn’t sure what she meant. The older I got, though, the more I came to understand. She didn’t want anything fancy or special. She just wanted to be happy. She just wanted to have enough.” (p. 276)

“This is what most business owners are doing: minimizing their payroll expenses as much as possible to maximize their own earnings. By choosing instead to pay all workers the same—focusing on what is ‘enough’—revenue is freed up to bring more workers on board, creating more ‘good jobs’ for our community.” (p. 284)—on running an equitable business, and paying all employees the same wage, which is something she’s known for

“I’ve always kind of thought that money just makes people more of whatever they already are.” (p. 294)—YES. I believe this too.

“The thing about capitalism is that it is fiercely individualistic. There are winners and there are losers, and from what I can tell there are a hell of a lot more losers than winners.” (p. 307)

And one longer quote from the beginning that feels worth sharing:

“Our childhoods set up our relationships with money, for better or worse. We absorb lessons about class from our surroundings. Our cities and towns shape our perceptions of normal, forming the basics for the scale we use to judge everyone around us moving forward. If you grow up in a town with more poverty, your scale slides just a little to the left—where normal is a little more broke. If you grow up in a town without poverty, your scale slides just a little to the right—where normal is a little better off.

Similarly, our parents’ incomes set the foundation for what we think an average income is—anyone with less than us is poor, anyone with more is rich. These are arbitrary standards that only make sense to us and people who are like us, with similar backgrounds and upbringings. We speak to each other and throw out these phrases—rich, poor, a good job, a bad job—as though they are terms with real meaning. In reality, when we use these words, we’re describing our own lives rather than concrete things about the world around us.” (p. 20)

What I didn’t like (spoiler: nothing)

Honestly, friend… I have nothing bad to say about this book. But as an editor, I kept thinking: surely, there’s always something!? You can’t just write a review that says “THIS IS AMAZING” and not have at least some kind of balanced look at what worked and what didn’t work. Can you!? In this case… I can. Because Madeline is an amazing writer, and my assumption is she also worked with an amazing editor. I would have to do a lot of work to try to find something I didn’t like about this book. That’s still a very personal review. The fact that I think it’s excellent doesn’t mean everyone who reads it will agree! But that’s how I feel, friend. It is excellent and I think everyone should consider reading it.

I did make one editor’s note:

When talking about how to build credit, the book says banks give you a “monthly limit” on your credit card (p. 23). That’s not true. It’s not monthly. It’s just… a limit. Sure, you could spend the total limit, pay off the full balance, get it back down to $0—and do that every month. If you had the cash flow, that’s totally possible. But if you spent the full limit in one month and couldn’t pay it off, you would not get more credit added to your limit the next month. You’d be maxed out. Many of us know this. But as an editor of a personal finance book, I would’ve wanted to make sure this was crystal clear to readers. Many financial products (especially debt products) were designed to be confusing. The more we can help each other understand how they work, the more informed decisions we can all make! Anyway, as an editor, I would’ve just said: remove the word “monthly,” so it’s not misleading.

Ok, I feel as though I could go on and on… but I’ll stop there. I hope that sums up my thoughts and feelings well enough. I have intentionally chosen not to include any of the stories in the book, because I think it’s worth reading them instead. But it’s safe to say: I loved this book. I’ve never read a personal finance book like it before, and can only hope more people write books like this in the future.

Oh, and if you were wondering: yes, there is a lot of information on how things work in the US (because that’s the country she lives in and is trying to navigate her way through). But I SURVIVED CAPITALISM… is a memoir, and it’s one that anyone can learn from. I know I did.

And, I’m grateful to Doubleday for the extra copy, so I can give 1 away!